Essential Planning: Key IRS Changes for Tax Year 2026

A look at tax changes for 2026

Introduction

This year has flown by—again—which means it’s time for everyone’s favorite seasonal tradition: pretending we’re definitely going to get ahead on next year’s financial planning.

The IRS has released inflation adjustments for tax year 2026 (returns filed in 2027), and several new tax breaks from the “One, Big, Beautiful Bill” (OBBBA) will take effect. It’s the kind of legislation that makes accountants… well, maybe not excited, but at least moderately stimulated. These changes will affect how much you owe, how much you can deduct, and how many times you’ll mutter “Why didn’t I buy more index funds?” next April.

Also, in this issue, I take a minute to look at a common misconception about tax brackets. If your income jumps from the “comfortable-but-not-rich” 24% tax rate straight into the “oh-dear-god-I’m-a-tax-target” 32% tax rate, a lot of people assume the government will suddenly demand 32% of every single penny you’ve ever earned. Spoiler alert: that is not the case. Only the sliver of your income that falls into the new bracket is taxed at that rate. More on that in a moment.

A quick reminder, because the lawyers told me to: this is not financial advice. This is just me sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different—some of you want a yacht, others just want to stop looking at your 401(k) statements. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you find this newsletter helpful, please share it with one friend who might find it useful by using the button below.

Retirement Plan And Notes For 2026

For those of you who’ve been loyally dumping cash into your retirement accounts, congratulations! The IRS is rewarding your diligence by letting you put even more money away, where you can’t touch it.

The contribution limit for traditional and ROTH IRAs in 2026 is $7,500, up from $7000 in 2025. Individuals aged 50 or older can make a catch-up contribution of $1,100, bringing the total contribution to $8,600.

The contribution limit has also changed for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government’s Thrift Savings Plan. Before, the limit was $23,500. Starting in 2026, that increases to $24,500.

For employees 50 and over, the catch-up contribution limit has increased to $8,000. So with the new limit of $24,500, you add that $8,000, and the contribution limit is $32,500 for employees 50 and up. Ideal for people who like to say, “I’m absolutely retiring at 60,” while silently knowing they’ll still be answering work emails at 72.

You can read more about changes for 2026 on the IRS’s official website at this link. (Warning: May induce drowsiness.)

HSA Changes For 2026

Good news for those of us trying to hoard cash for future medical bills (or just a nice tax-free retirement slush fund): the contribution limits for Health Savings Accounts (HSAs) are getting a modest bump for 2026.

If you have self-only coverage under a High Deductible Health Plan (HDHP), you can now stash away a maximum of $4,400 (up from $4,300), and the family coverage limit jumps to $8,750 (up from $8,550).

The $1,000 catch-up contribution for the over-55 crowd remains the same—because apparently, the cost of needing glasses doesn’t inflate as fast as everything else. Also, eligibility is expanding to include all Bronze and Catastrophic ACA plans and certain Direct Primary Care arrangements, meaning millions more people can now enjoy the triple-tax benefit of these accounts: deductible contributions, tax‑free growth, and tax‑free withdrawals for qualified medical expenses.

Higher Standard Deductions

The standard deduction is a fixed dollar amount that makes your taxable income magically shrink. It’s like a participation trophy from the government—almost everyone qualifies for it, and you take it instead of itemizing deductions like mortgage interest or charitable gifts. The IRS adjusts it each year for inflation, and certain groups—such as people 65 or older or those who are blind—can qualify for an additional amount. Taking the standard deduction is usually the simpler and more beneficial choice unless your itemized deductions are higher, which means less math and fewer receipts labeled “charity donation” that were definitely brunch.

For 2026, the standard deduction will rise above inflation:

Married filing jointly: $32,200 (up from $30,700 in 2025)

Single / Married filing separately: $16,100 (up from $15,750)

Head of household: $24,150 (up from $22,700)

Because the standard deduction is now so high, your chances of benefiting from itemizing deductions like mortgage interest or state/local taxes are shrinking faster than your motivation to actually read the tax code. Unless you’ve made a truly obscene number of charitable gifts this year or bought a second mansion, you can probably toss that file folder of “deductible expenses.”

Updated Tax Brackets

The top federal income tax rate remains 37%, because of course it does. But the income thresholds for each bracket are shifting upward in 2026, giving you the illusion of paying less tax—kind of like when your favorite store raises prices but offers a “sale.”

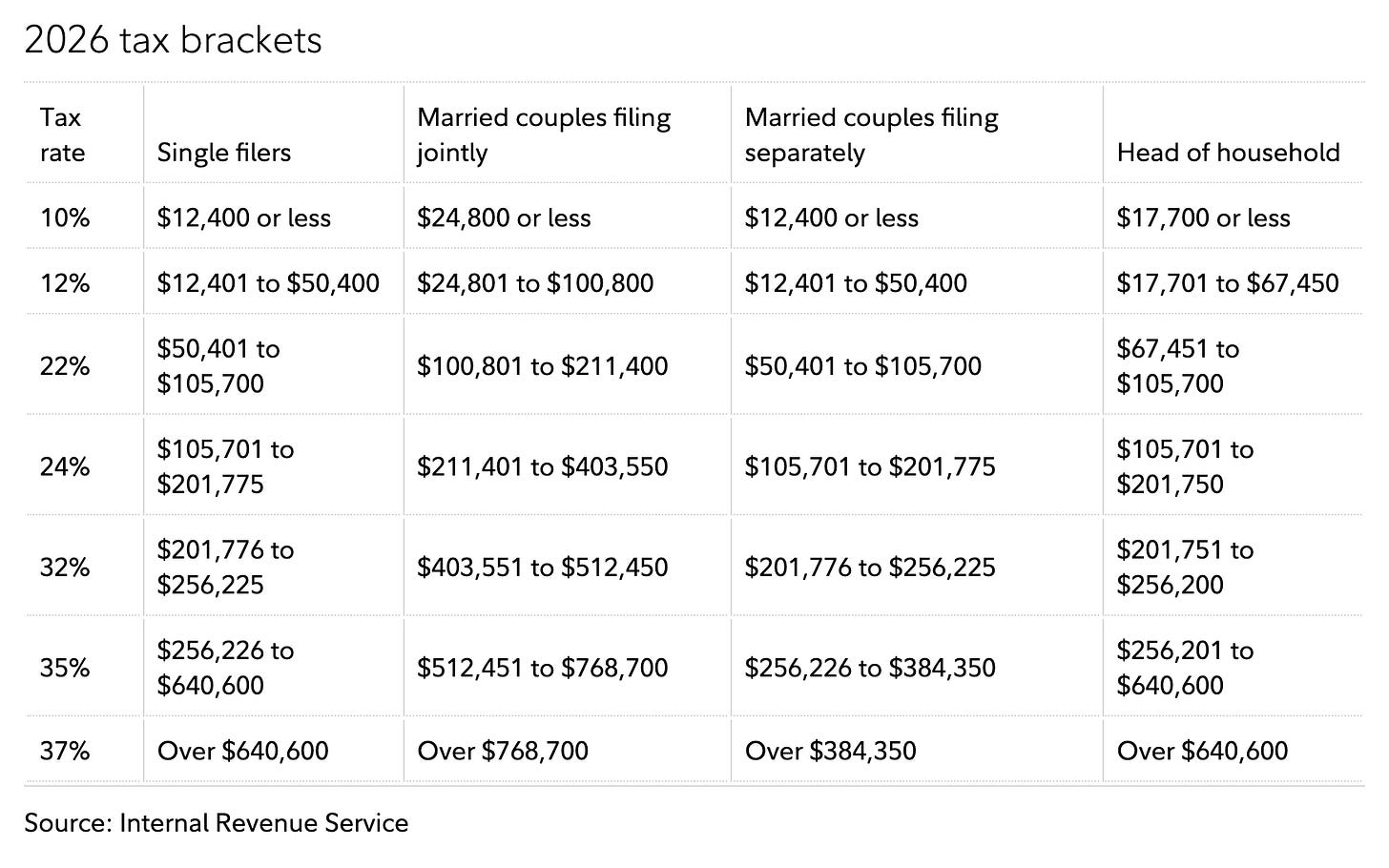

The 37% bracket starts at $640,600 for single filers and $768,700 for married couples filing jointly. Other brackets (10%, 12%, 22%, 24%, 32%, 35%) are also adjusted upward for inflation, so more of your income will be taxed at lower rates compared to 2025. You can check out the updated 2026 tax brackets below:

A Common Misconception About Tax Brackets

The most common misconception is that if a raise bumps you into a higher tax bracket, all of your income is suddenly taxed at that brutal new rate. If you think this, please stop immediately. This myth has been used by fearful people to justify turning down raises for decades.

Here’s the truth: we have a progressive tax system, which means your income is taxed in layers, like a delicious but overly complicated tax lasagna. You do not pay your top bracket rate on every single dollar you earn—only on the dollars that fall into that specific bracket.

So, for instance, if a person is a single filer who earns $60,000, using the tax brackets table above, they would fall into the 22% tax rate. So the tax bill would look like:

First $12,400 → taxed at 10% = $1,240

Next $38,000 ($12,401–$50,400) → taxed at 12% = $4,560

Last $9,600 ($50,401–$60,000) → taxed at 22% = $2,112.

In this example, the total tax owed is $7,912 ($1,240 + $4,560 + $2,112). So even though this person is in the 22% bracket (the marginal rate), their actual effective tax rate (total tax paid divided by total taxable income) is only:

$7,912 / $60,000 = 13.2%

So, a person in the “22% bracket” actually pays just over 13% of their income in taxes. The entire $60,000 income is not being attacked by the highest percentage—just a small, carefully measured slice.

Conclusion

The real takeaway from these 2026 changes is this: don’t panic, but don’t be lazy. The higher contribution limits mean you can shove more money into your retirement accounts and shield it from immediate taxation, and the beefier Standard Deduction means you can probably stop stressing over whether that receipt for office supplies is truly deductible.

Take a moment to review these new numbers. Figure out where you fall in the updated brackets (congratulations on being even mildly richer!), and consider the timing of any big financial moves. After all, the only thing worse than paying taxes is paying too much tax because you missed a memo.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: