Biggest Investment Mistake I Make, My Updated Stock Portfolio

KO is out of my portfolio, several others are in

Introduction

The market has been on a roller coaster this year — and not the smooth, Disney kind. More like the rickety one at the local fair that makes you question your life choices halfway through.

After taking a huge plunge between February and April, the Dow, S&P 500, and Nasdaq 100 all hit record highs this month. In this newsletter, I’ll confess to an investment mistake that has haunted me for years (yes, still), and how I’m finally planning to stop tripping over the same rock.

Also, it’s been over a year since I shared my stock portfolio. Since then, I’ve made quite a few changes. A lot has changed since then — think “new season, new cast.” I’ll walk you through what’s different and why.

Disclaimer: This is NOT financial advice. I am just sharing my strategies, investments, stocks, and index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

My Big Investment Blunder

One of the best things I’ve been able to do in my decades of investing is to stay cool when the market is in a downturn and look at it as a buying opportunity. When other people are panicking, I’m the weirdo calmly adding stocks to my cart like it’s Black Friday at Costco.

In the newsletter I sent in March, when the market was tanking, I wrote about how it was a major buying opportunity and used an example of how I was loading up on NVIDIA at $105. I also added to pretty much every position I held. During that downturn from February to May, in just my stock account, I bought equities 68 times.

While I’m good at buying when the market is tanking, I have the opposite problem when the market is on fire. Suddenly I turn into that person at the buffet who “saves room for later” and ends up missing the good stuff.

From May until this past week, I’ve only bought equities 19 times. That’s like going from running a marathon to doing a light jog because the weather’s too nice. Most of those buys were after a stock took a hit — basically me standing on the sidelines waiting for the “perfect” pullback that never came.

As an example, SOFI is one stock that I started buying in January. I added a lot during the downturn when the stock was under $15 / share. I’ve only added to my SOFI position twice since then. Today it’s trading at a little over $25. If I had just continued to buy when the market got on fire again, I would have caught it at $17, $18, $19, etc., and I’d be doing a happy dance. Instead, I’m doing the “shoulda, coulda, woulda” shuffle.

I made the age-old, utterly predictable, yet apparently irresistible mistake of waiting for the market to cool down when it’s on fire. It’s the mistake I see a lot of people make who want to start investing—they think it’s best to wait for prices to come down, and in that time, they miss all the glorious returns. Bless their hearts. I know their pain, because I’m one of them. I’m a seasoned investor who still acts like a first-timer when the market gets a little hot.

Fixing this mistake

In my past newsletters, I’ve mentioned that I keep a separate account for ETF investing (which is mostly for dividend income). In that account, I dollar-cost average into about a dozen ETFs weekly — like a responsible adult who sets the thermostat to “auto.” That account is boring in the best way. I invest in about a dozen ETFs weekly, rain or shine, bull or bear. This smooths out entry points and reduces regret.

With my stock account, I don’t dollar-cost average as I make separate decisions for each position, which is fine in theory but turns me into an overthinker in practice. So, I’m changing that.

I’ve set a reminder every Thursday to buy something. Big position, small position, whatever. It’s like dollar-cost averaging, but with a sprinkle of strategy. This way, I stop waiting for a “perfect” entry point that doesn’t exist outside of hindsight.

Mistakes Other Investors Make In A Hot Market

Many people make the opposite mistake when the market is hot. When the stock market is soaring, people lose their minds. Everywhere you look, it seems like stocks are only going up. Suddenly, everyone’s a genius. I start hearing phrases like “can’t miss” and “my buddy’s cousin’s barber gave me a stock tip.”

While a hot market can be a great time to see your portfolio grow, it's also a time that calls for a cool, disciplined approach. The last thing you want to do is get burned by making impulsive decisions. Here are some steps I take during these times.

Stick to the plan. Hot market ≠ new rules. If you already have an allocation strategy (stocks, bonds, cash, alternatives), stay disciplined. A hot market doesn’t mean the rules change—it could very well mean that they’re about to be tested.

Dollar-cost average. As I noted earlier, I do this with my ETFs, as well as our various retirement accounts. Consistency over timing. Slow and steady beats “YOLO” nine times out of ten.

Avoid lottery-ticket stocks. Just because a stock doubled in six months doesn’t mean it’s going to double again. Sometimes it just… stops (or crashes hard).

Don’t confuse market luck with personal genius. This one’s hard. The mirror loves to tell us we’re investment prodigies. Spoiler: the mirror often lies.

Don’t gamble with money you’ll need soon. Markets don’t care about your vacation to Maui.

Keep an emergency fund. A hot market can cool down quickly—usually the moment you invest your rent money. Liquidity ensures you won’t have to sell at a bad time.

My Updated Stock Portfolio

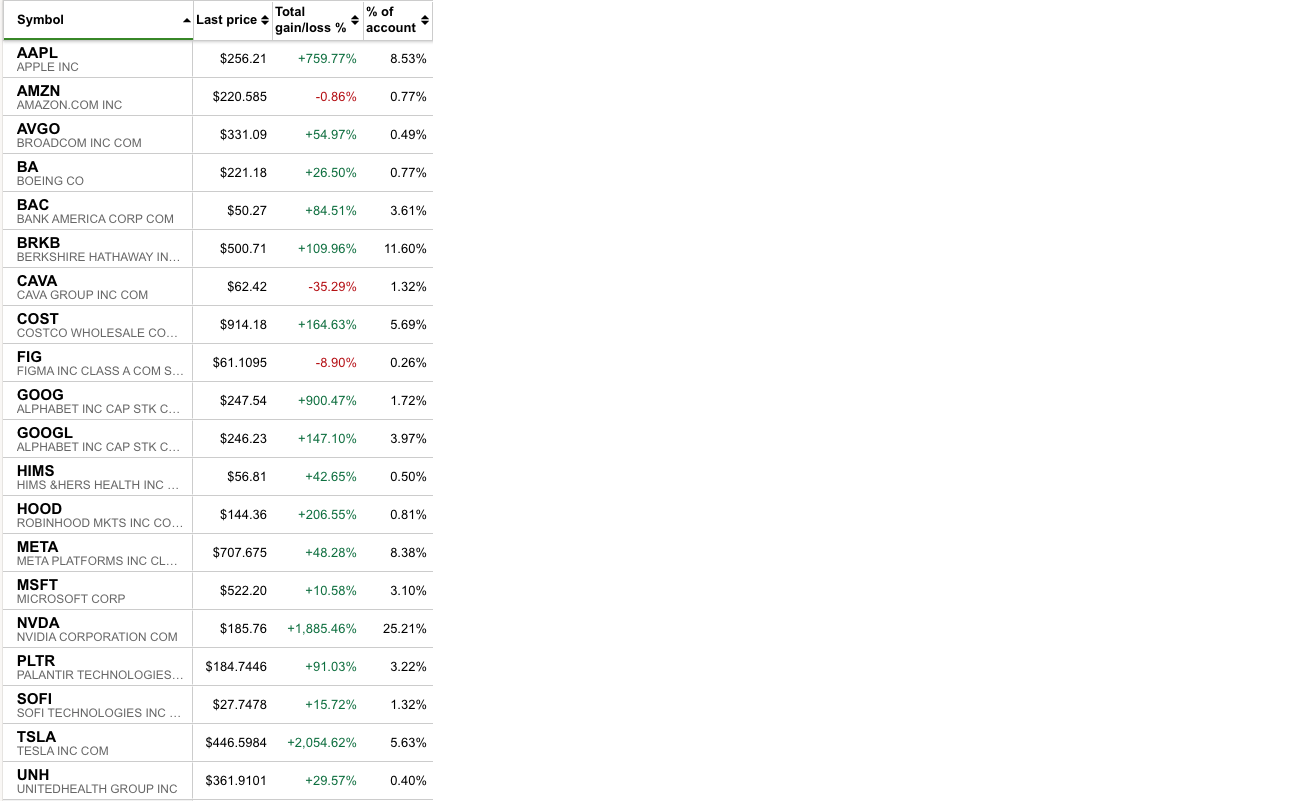

In August of last year, I shared my stock portfolio. The only stock I dropped since then was Coca-Cola (KO) this past January. (Sorry, Coke, but you weren’t providing enough fizz for my portfolio.) Whenever I sell a stock, I make sure to buy something else, even if it’s just an S&P 500 index fund like VOO (the ultimate safe space).

I had a big position over the years in Coca-Cola, so instead of taking the proceeds from that sale and buying just one stock, I ended up buying 6 stocks: Broadcom Inc. (AVGO), Boeing (BA), Hims & Hers Health (HIMS), Robinhood (HOOD), Palantir (PLTR), and SOFI (SOFI).

Since then, I also bought UnitedHealth Group (UNH) when it took a nosedive, Amazon (AMZN) and FIGMA (FIG) after that stock dropped (and unfortunately continued to drop, proving that I am, in fact, still capable of being wrong. However, I may buy more soon, because what’s life without a little double-or-nothing?).

Below is my updated stock portfolio:

Conclusion

I think the long story short is to keep investing, whether the market is in a downturn or red hot. Just try not to be me and only be enthusiastic when the metaphorical ship is sinking.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: