How To Get Started Investing In 2025

A look at how to finally get investing

Introduction

Happy New Year! Thank you to all of you who helped this newsletter nearly triple in readership last year.

I’ve gotten many Twitter X DM’s and emails since I started this email with people saying they want to invest, but don’t know where to start. Investing can seem intimidating, like some exclusive club for Wall Street wolves who wear monocles and understand what a "derivative" actually is. (Fun fact: I don’t really know either, and I’m doing just fine.) But the truth is, it's for everyone. Yes, even you, the person who still hasn't figured out how to use the self-checkout.

Everyone’s risk tolerance and financial goals are different, so there is no blanket way on how to start investing. However, I am helping a family member get into investing and will share the steps we’re taking below.

This is a quick reminder that this is not financial advice. I am just sharing my strategies, investments, stocks, and index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert.

Also, if you found this newsletter helpful, please share it with one friend who might find it useful by using the button below.

What To Do Before You Start Investing

Before you decide to start investing, you first want to get rid of consumer debt (I wrote about how I got out of credit card debt here) and create an emergency fund that can cover 3 to 6 months of living expenses. For the emergency fund, I would put it in a high-yielding savings account that’s FDIC-insured (I wrote about my top 5 high-yield savings accounts at this link). “High-yield” here means 4-4.5%, which is down from the highs of recent years, but it’s still pretty decent. Also if your job has a 401K account with employer matching, contribute the full amount that your employer will match as that’s an easy 100% return.

Also, know your risk level. Letting your money sit in a savings account is like watching paint dry... except slower and less exciting. Inflation is a sneaky beast that erodes your purchasing power over time. Investing, on the other hand, gives your money a chance to grow and outpace inflation. However, if you’re watching your investments daily and hastily selling when the market is down and buying when it’s high, a savings account may be the better way to go.

Before diving headfirst into the stock market, take a good look at your financial situation. How much can you realistically afford to invest? The general rule of thumb is to invest 15% of your gross income.

Also, set some goals. What are you investing for? Retirement? A down payment on a house? A lifetime supply of tacos? Having clear goals will help you determine your investment timeline and risk tolerance.

Open An Investment Account

I’ve found that this is the step a lot of people get hung up on, but it's like ripping off a financial bandaid. It’s the step where you’re committing to investing. There are plenty of online brokerages that make it easy to open an account and start investing with relatively small amounts of money. Some popular options that I have experience with include Fidelity, Charles Schwab, and Vanguard. I wrote a newsletter last year comparing the three. I’m a fan of Fidelity and Schwab, not so much with Vanguard, but they all work. For my family member, we’re using Fidelity. To get started with any of the three, just do the following to get started:

Fidelity: Fidelity has a clean interface that is user-friendly and great customer service. To open an account, go to Fidelity.com and click the “Open an Account” button on the home page:

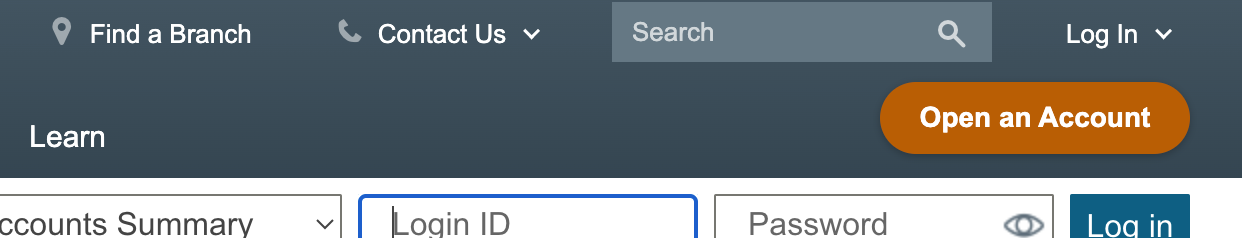

Schwab: Schwab also has a clean interface albeit a little more complex, and they also have great customer service. Go to Schwab.com and click the “Open an Account” button on the right hand side of the top bar:

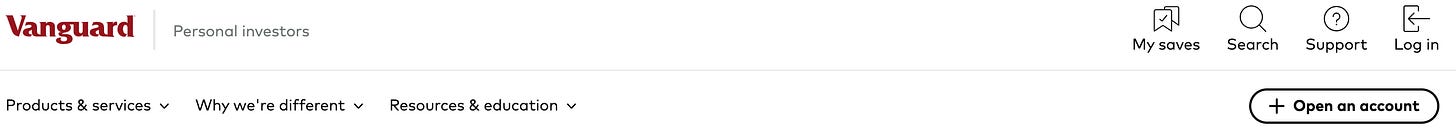

Vanguard: Solid, but their website feels like it was designed by someone who thinks AOL is still cutting-edge. Also, they have the weakest customer service of the three. To get started there, go to Investor.vanguard.com and click “+ Open an account” on the right-hand side of the top menu:

Choose The Type Of Investment Account

Next, you want to decide on the type of account. For the purpose of this newsletter, I’m going to keep it simple and look at brokerage accounts and IRAs (Individual Retirement Accounts).

In general, I recommend people max out their retirement investments before opening a regular investing account. For my family member, we’re opening a regular brokerage account. Here’s a quick look at the two:

1. Brokerage Accounts

A brokerage account is a versatile investment account that allows you to buy and sell a wide range of securities, including stocks, bonds, mutual funds, and ETFs. Think of these as your investment playground. These accounts come in two main types:

Taxable Brokerage Accounts: Earnings such as dividends and capital gains are subject to taxes in the year they’re realized.

Managed Brokerage Accounts: These accounts are managed by financial professionals who make investment decisions on your behalf, often for a fee.

Best for: Investors seeking flexibility and access to a broad range of investment options.

2. Individual Retirement Accounts (IRAs)

IRAs are designed to help you save for retirement with tax advantages:

Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred. Withdrawals are taxed as income in retirement.

Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free, provided certain conditions are met.

Best for: Individuals looking to build retirement savings while taking advantage of tax benefits.

Choose Your Investments

This is where things can get a little more complex, but I’ll keep it simple. Here are a few basic investment options:

Stocks: Represent ownership in a company. They can be volatile (think mood swings on steroids) but also offer the potential for high returns.

Bonds: Represent a loan to a company or government. They're generally less risky than stocks but also offer lower returns, but you won’t lose sleep at night.

Mutual Funds and ETFs: The lazy person’s guide to diversification, which is why they’re my personal favorite. These are like baskets of stocks or bonds, offering diversification and professional management.

I have a mix of all of the above, but my recommendations for most of my friends and family are low-cost index funds and ETFs. Last October, I wrote about my 2-ETF fund portfolio to get rich, which consists of the Vanguard S&P 500 ETF (VOO) and QQQ (Invesco QQQ Trust). For my family member, we are starting with just VOO since it is less volatile, and once they become more comfortable, we will likely move to the 2-ETF fund portfolio and add QQQ. Baby steps, people.

Take expert advice with a grain of salt

I do pay attention to finance news, but I also try to block out a lot of the noise. For last year, this is what the top analysts predicted for where the S&P 500 would end up:

• JP Morgan: 4,200

• Morgan Stanley: 4,500

• Bank of America: 5,000

• Goldman Sachs: 5,100

• Citi: 5,100

The S&P 500 ended up closing at 5,881.63, beating even the most bullish prediction from Goldman Sachs by 15%. The S&P 500 ended up surging 23% in 2024, building on the 24% gain it had in 2023. However, JP Morgan and Morgan Stanley predicted the S&P 500 to dip last year, while Goldman Sachs, Bank of America and Citi only predicted a 5-7% gain. If you stayed out of the market last year, you might have missed out on some pretty nice returns. So while it’s great to stay educated, at times you also need to block out the noise.

Start Small and Stay Consistent (Rome Wasn't Built in a Day, and Neither Is a Fortune)

You don't need to invest a huge lump sum to get started. Even small, regular contributions can add up over time thanks to the magic of compounding. With this new account, we have set up an automatic monthly contribution to VOO.

Conclusion

Investing doesn't have to be scary or complicated. It’s more like assembling IKEA furniture: frustrating at first, but satisfying when it all comes together. Dip your toes in the market, and before you know it, you’ll be the friend casually mentioning your "investment strategy" at brunch (humble brag included). It’s not about being perfect — it’s about showing up and taking that first step.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: