Practical Money: Your Last Chance to Cut Your 2025 Tax Bill

A look at strategies to lower your 2025 tax bill

Introduction

The clock is ticking! As 2025 limps toward the finish line, it’s your final chance to make some final, panicked strategic moves to lower your tax bill—or at least make next April slightly less painful. Sure, many tax strategies require “long-term planning,” but for the rest of us last-minute savants, there are still a few power plays you can make before New Year’s Eve.

Don’t leave money on the table—those NFTs aren’t going to buy themselves. Below are some last-minute strategies I’m personally using before the year ends, along with a surprisingly awesome tax-loss harvesting tool from Fidelity that will automate the sadness of realizing your investments suck.

Also, a quick correction: In the last newsletter, I wrote that the contribution limit for traditional and ROTH IRAs in 2026 is $8,000, when it actually is $7,500. Individuals aged 50 or older can make a catch-up contribution of $1,100, bringing the total contribution to $8,600. That’s what happens when I write a newsletter before having my 9th cup of coffee.

A quick reminder, because the lawyers told me to: this is not financial advice. I am not a fiduciary, a CPA, or even particularly good at assembling IKEA furniture. This is just me sharing my strategies, investments, stocks, index fund strategies, what I'm buying, and where I plan to take those investments. Everyone’s financial goals are different—some of you want a yacht, others just want to stop looking at your 401(k) statements. No financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not a substitute for advice from a qualified professional who actually knows your situation and charges by the hour.

Also, if you find this newsletter helpful, please share it with one friend who might find it useful by using the button below.

Maximize Your Retirement Contributions

It’s always important to pay future you, because you’re going to be expensive. One of the most powerful — and least exciting — year-end moves is stuffing more money into tax-advantaged retirement accounts. Thrilling? No. Effective? Very. Give the money to your Future Self, who is much better looking and deserves it, instead of the taxman. Here are some ways to do just that:

Maximizing 401(k) / 403(b) / 457(b) accounts: If you have an employer-sponsored retirement plan, this is your chance to lower your taxable income while pretending you enjoy delayed gratification. You generally have until the end of the year to make your final contributions. Usually to change your contribution amount to reach your limit, you’ll have to contact your employer’s HR department, which is its own special form of penalty. The 2025 contribution limit is $23,500 ($31,000 if you’re 50+ because, like me, you’re running out of time). The deadline for those contributions is December 31, 2025.

Think of it as paying your future self — who will almost certainly be more tired and less employable than you are now.Contribute to an HSA: HSAs are criminally underrated. I only started using one last year and immediately regretted not starting sooner. If you have a High Deductible Health Plan, this account is a unicorn:

Contributions are tax-deductible

Growth is tax-free

Withdrawals for qualified medical expenses are tax-free

That’s the holy trinity of tax advantages. And for the procrastinators among us (my people): you actually have until April 15, 2026, to make HSA contributions for 2025. That’s right, you can still put this off for a few more months. You’re welcome.

ROTH and Traditional IRA contributions: If eligible, consider a traditional or Roth IRA contribution. I wrote an entire newsletter about ROTH and Traditional IRAs - as well as the pros and cons of each - which you can read at this link. For 2025, you can contribute up to $7,000 (or $8,000 if you’re 50+). Like HSAs, you have until April 15 to get this done — so yes, you can kick this can down the road a bit longer.

Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated strategy to sell investments that have lost money to reduce the amount of income taxes you’ll owe. It’s like a financial participation trophy—you lost money, but at least you get a deduction! Many savvy investors utilize this at the end of each year to essentially tell the government, “See? I lost money, too. Share my pain.”

Here’s how it works:

Realized losses can offset realized capital gains

If losses exceed gains, you can deduct up to $3,000 against ordinary income ($1,500 if married filing separately)

The rest of your shame (the “remaining loss”) can be carried forward indefinitely, like a sad, financial IOU you can cash in later.

Studies have shown that tax-loss harvesting added nearly 1% in annual returns from 1928–2018. That may not sound exciting, but over decades it’s the difference between “comfortable retirement” and “working part-time at Home Depot for fun money.” I wrote a newsletter about using tax-loss harvesting to your advantage that you can check out here.

As always with tax-loss harvesting, you want to watch the Wash Sale Rule. To claim the deduction, you cannot buy the same or a “substantially identical” security within 30 days before or after the sale date. Think of it as a 61-day time-out the IRS imposes because they know you really want that stock back, and they’re just trying to make it awkward.

The Rare & Elusive Tax-Gain Harvesting: Here’s a little loophole for the overachievers: The 30-day wash sale rule only applies to losses. It does not apply to gains. So, you could sell a profitable security and immediately reinvest the proceeds in the same security. This maneuver allows you to maintain your original investment position and establish a higher cost basis, meaning you’ll pay less tax when you sell it for real later.

Fidelity’s Magical Tool: Outsourcing Sadness

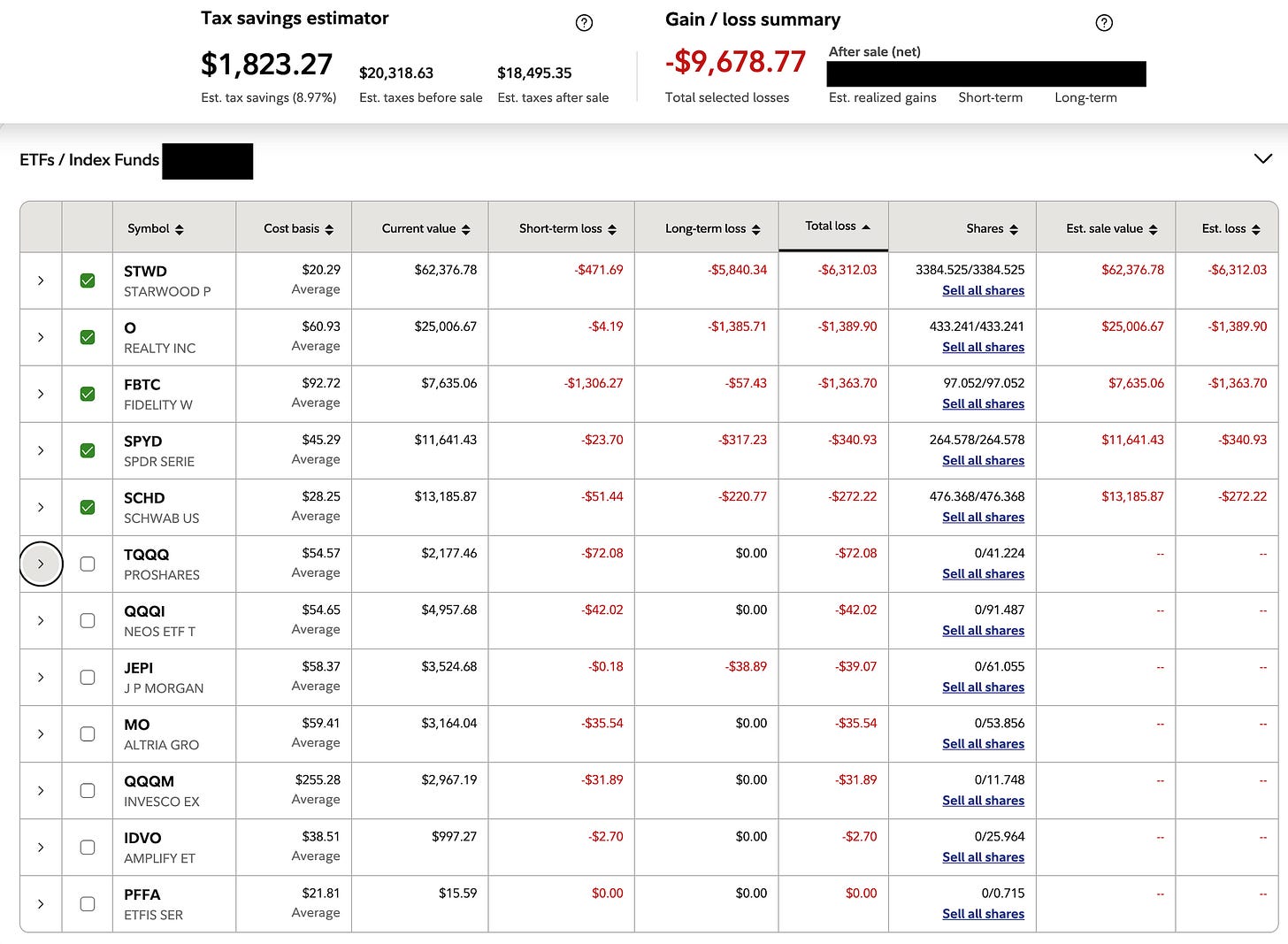

This year, Fidelity introduced a new tax-loss harvesting tool for their customers that is pretty awesome. It lets you select specific shares of positions that are currently at a loss — instead of blindly selling everything and hoping for the best. This would have saved me a lot of manual work in the past, but hey, character building is important.

If you’re a Fidelity customer, you can check out the tool here:

https://digital.fidelity.com/ftgw/digital/tax-loss-harvesting/

I’ve already utilized it in my “Stocks” account, but you can check out a screenshot below of it harvesting losses from my “ETF / Index Funds” account. Note that this tool only selects shares that are currently underwater. For instance, with FBTC below, I own almost 1,000 shares, but it’s only selecting the 97 shares that are at a loss today. It’s like a compassionate AI saying, “I know you’re only feeling pain on a small portion of your assets today, let’s at least get a write-off for that.”

Prep Your Deductions: Itemize vs. Standard

Before year-end, take five minutes to estimate whether itemizing actually beats the standard deduction. For 2025, the standard deductions are:

Single: $15,750

Married Filing Jointly: $31,500

Head of Household: $23,625

If your itemized deductions are higher, congratulations! You get to spend hours tracking down receipts and file 50 extra pages to save a bit of money. If not, congratulations! Take the standard deduction and put those hours into watching something on Netflix instead.

If you have decided that you love paperwork and plan to itemize, here are some things to consider:

Prepay Taxes (Because Timing Is Everything): You may want to prepay state and local estimated taxes or your January property tax bill before December 31. The SALT deduction cap is temporarily raised to $40,000 for 2025, which is especially meaningful if you live in a high-tax state.

Charitable Contributions: Donating to charity can reduce your tax bill and make you feel like a good person — a rare double win. You might consider donating appreciated stock instead of cash; this can avoid capital gains tax while still generating a potential deduction.

Donor-Advised Fund (DAF): If you’re having a super high-income year, consider funding a DAF now to claim an immediate tax deduction for 2025, even if you don’t grant the money to charities until later. This is an excellent tactic for “bunching” multiple years of donations into one high-income year to exceed the standard deduction. It’s the ultimate “have your cake and deduct it too” strategy.

Accelerate deductible expenses: You can pull next year’s deductible expenses into this year (like by paying January’s mortgage payment) on your 2025 return. This can be especially helpful if you are close to the threshold where itemizing becomes more advantageous than the standard deduction.

Other Strategies

If you’re 73 or older, ensure you’ve taken your RMDs from retirement accounts. Missing the deadline could result in hefty penalties.

If you expect to be in the same or a lower tax bracket next year, deferring income into 2026 can reduce your 2025 tax bill. For instance, if you are receiving a year-end bonus, ask if you can be paid in January instead of this month. You can also push invoicing into the following year if cash flow and contracts allow.

Update your W-4 or quarterly payments. If you’ve had significant life changes in 2025—like a new job, marriage, or major purchase—ensure your tax withholding or estimated payments reflect your current situation to avoid surprises.

Look at credits. Credits reduce tax dollar-for-dollar and can be more powerful than deductions, especially at the last minute. They’re a dollar of tax reduction for every dollar of credit, which is better than a deduction, which is just tax-flavored money back. Some of the most valuable credits relate to dependents, education, and energy-efficient home improvements (so yes, maybe that solar roof was a good idea after all).

Conclusion

These are just some of the major items I look at every year; there are many, many others, mostly involving the fine print and a large bottle of wine. A few well-timed decisions before December 31st can lead to meaningful tax savings and fewer unpleasant surprises when filing your 2025 return.

It’s always best consult a tax professional. Not your cousin who “does taxes on TurboTax for fun.” A real one. You deserve to outsource your misery. They can tailor strategies to your specific situation and prevent you from confidently doing something very wrong.

That's it for this week! As always, no financial decisions should be made solely on this newsletter, which is for informational and entertainment purposes only and is not intended to be a substitute for advice from a professional financial advisor or qualified expert. If you haven’t already, please subscribe to this newsletter below and never miss an update: